Is Bench Bookkeeping Right for You?

Bench is a popular online bookkeeping service that works with clients around the U.S., just like us. We often have potential clients call us and ask,...

Are you a business owner who dreads the thought of filing your taxes each year because it feels like understanding all the details and rules surrounding 1099 forms is impossible? Well, fear not–you are not alone! This seemingly complicated process doesn’t have to be so difficult. In fact, with a bit of knowledge about IRS regulations pertaining to 1099 forms, you can easily prepare for tax season and feel confident that completed documents are in compliance with existing laws. So let’s get started unpacking the mystery surrounding 1099 forms–let's uncover exactly what you need to know before filing this crucial paperwork.

The 1099 Form is an essential document when it comes to filing taxes. It’s important to understand what a 1099 Form is, the types of forms available, and regulations pertaining to them in order to be prepared for tax season. Here we’ll provide an overview of the most relevant 1099 Forms for you and how you can easily prepare for the upcoming tax season.

|

Table of Contents |

|

What is the difference between Form 1099-MISC and Form 1099-NEC? |

1099 forms are an important part of filing taxes for many businesses and self-employed individuals. 1099 forms are used to report all kinds of income that aren't reported on a W-2 form, such as dividends, interest, royalties, rents, and payments from independent contractors. There are different types of 1099 forms depending on the type of income being reported, and we will primarily be focusing on Form 1099-MISC and Form 1099-NEC in this article.

You must file a 1099-MISC if you have paid a qualified person or a business (aka a 1099-Vendor):

At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest

At least $600 in:

Rents

Prizes and awards

Other income payments

Generally, the cash paid from a notional principal contract to an individual, partnership, or estate

Any fishing boat proceeds

Medical and health care payments

Crop insurance proceeds

Payments to an attorney

Section 409A deferrals

Nonqualified deferred compensation

You must also file Form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

The 1099-NEC is one of eighteen types of forms created by the Internal Revenue Service (IRS) to report income. This particular form is designed for businesses that need to declare payments made to non-employees during the tax year, such as independent contractors or sole proprietors. It should not be used for employees' wages and salaries.

Prior to the year 2020, this information was presented on a 1099-MISC form. The Internal Revenue Service has reintroduced its version of the 1099-NEC form and is now used exclusively for these reports. Need even more specifics? You can find all answers regarding what you should report on your 1099-MISC form directly from their website!

Essentially, you must file a 1099-MISC if you have paid a person or a business:

At least $600 in:

Services performed by someone who is not your employee (including parts and materials)

Payments to an attorney

In the past, we only had to file Form 1099-MISC for things like rent or contractor payments, but the IRS has split these types of payments into two different forms. Generally. our clients only see rent on Form 1099-MISC and everything else on Form 1099-NEC

You may have noticed that "payments to an attorney showed up on both lists which can be quite confusing, especially since the IRS tends to use complicated language that has to be read a few times to be sure of their intent. I'll break it down...

If the payment made to an attorney was in relation to a settlement agreement, you would file a 1099-MISC.

If you paid an attorney for their legal services, you would file a 1099-NEC.

Also, the S-Corporation and C-Corporation filing exemption does not apply to an attorney, No matter what their corporate status, you must file a 1099-MISC or 1099-NEC if their payment exceeds $600 for the year. 😐

Payments to corporations (except attorneys' fees and gross proceeds).

Payments for merchandise or freight.

Payments of rent to real estate agents/property managers (they must report rent to property owner).

Wages paid to employees (reported on Form W-2 instead).

Business travel allowances paid to employees.

Cost of group-term life insurance for former employees.

Payments to tax-exempt organizations.

Reimbursements to employees for business expenses.

Payments made to homeowners under the Hardest Hit Fund.

Difficulty-of-care payments that are under the filing threshold.

Canceled debts

W-9 Requests can be a really daunting challenge, but gathering and storing W9s from vendors is an essential part of keeping financial records accurate and up-to-date. Without the right tools, it can be a difficult and time-consuming task. Fortunately, there are now solutions available to simplify the process and make it easier than ever before. Using a system like TrackW9, can help you quickly and easily gather all of your vendor's W9s in one secure location and manage them all with ease.

TrackW9 allows you to manage their W-9s electronically, eliminating the need to print out paper copies or manually enter data into spreadsheets. It requires minimal setup time so you can get started quickly, leaving you more time to do the real work. It's designed to be user-friendly so you don't have to worry about complicated configurations or technical issues slowing down your workflow. Plus, their customer service team is always available to help if you ever have any questions along the way. With TrackW9, collecting and managing vendor W-9s doesn’t have to be a chore anymore—it's simple and efficient!

If you are one of our clients, we manage the collection of W9s for you. All you have to do is provide your vendor's contact information (email and phone number) and we will check in with them long before it's time to file forms. We file thousands of 1099s per year, and there is nothing worse than chasing someone down at the 11th hour to gather a form that they don't have time to fill out.

Here is a video about how TrackW9 works.

Essentially, this service is making sure that you have the most important information on file, including their:

Legal name

Type of Entity

EIN or Social Security Number

Address

If you don't want to use TrackW9 to collect W9s forms your vendors, you can always do it the old fashion way.

Just remember to save this in your file management system, like Box or Dropbox, so that you easily find it later.

Generally, 1099s are due by January 31st, though the deadline may change slightly from year to year if this date falls on a weekend. If that is the case, the forms would be due the next business day.

It is important that you also retain copies of all Form 1099’s that are issued, in case you are audited by the IRS or requested for proof of payment from one of your contractors. Additionally, it is important to keep any financial statements, receipts, bills, or accounting reports that triggered you to file 1099s, for at least 7 years after filing your return. Keeping organized records will help protect against potential audit issues since it provides proof that all documentation was completed accurately and timely throughout the year.

The IRS assesses stiff penalties for filing the 1099-MISC late or not filing at all.

Failure to file correct information returns by the due date - There is a penalty of $50 per information return if you fail to file correct information returns by the due date. The penalty is capped at $565,000 per year ($197,500 for small businesses).

Failure to furnish correct payee statements - There is a penalty of $50 per payee statement if you fail to provide correct copies to payees by the due date. The penalty is capped at $565,000 per year ($197,500 for small businesses).

Intentional disregard of filing requirements - If failures are due to intentional disregard of requirements, the penalty is $570 per information return with no annual cap.

Failure to file correct information returns due to intentional disregard - If failure is deemed intentional, the penalty is at least $570 per information return with no cap.

Failure to furnish correct payee statements due to intentional disregard - At least $570 per statement to recipient if intentional disregard of requirements is found.

Continuing failure to file/furnish required returns - There are additional monthly penalties if failures continue for more than 30 days after you are notified of penalties, up to a maximum of 12 months.

Failure to furnish TIN - There is a $280 penalty for each failure to furnish a correct Taxpayer Identification Number (TIN).

In summary, late filing and furnishing of 1099s can lead to steep penalties per information return, with higher penalties for intentional failures. Filing complete and accurate 1099s on time is crucial to avoid these costly IRS penalties and enforcement actions

The following are exceptions to the failure-to-file penalty.

Reasonable Cause - The penalties may be waived if the IRS determines there was reasonable cause for the failure to file or furnish correct 1099s by the due date. However, the taxpayer bears the burden of proving reasonable cause.

First Time Penalty Abatement - The IRS may waive the penalties for first-time late filing or furnishing if the filer has a clean compliance history for the prior 3 years. This is a one-time waiver.

Statutory Exceptions - If the failure was due to certain events such as casualty, natural disaster, or other disturbance, the penalties may be waived.

Other Waivers - The IRS also has the discretion to waive penalties based on the facts and circumstances of a taxpayer's specific situation. However, this rarely happens.

Some other things that can help avoid late filing penalties:

Using an IRS-approved third party transmitter if filing 250+ 1099s.

Properly correcting errors via the Form 1099-MISC or 1099-NEC correction process.

Having a compliant 1099 electronic filing system in place.

Reasonable cause, first-time abatement, and certain statutory exceptions can provide penalty relief in some cases. But the best approach is proper diligence, testing, and measures to ensure accurate 1099 filing by the deadlines.

Before you can file 1099s, it is important that your accounting is up to date and accurate, or you risk under or overreporting your vendor's payments to the IRS. Using an accounting system like Xero will allow you to keep track of all of the inflows and outflows of cash without having to work in a messy spreadsheet or dates accounting software.

We only use Xero with our clients, because we know our time is better spent doing the work and guiding our clients, rather than struggling with software. We use Xero's 1099 report to track which accounts within the chart of accounts are used to pay vendors, how much each vendor has been paid, and when it is time to gather 1099s from our clients' vendors. It also has a handy feature that lets us exclude payments to C-Corporations or S-Corporations and payments made via Paypal and other excluded forms of payment. The rules we set up can be transferred year over year which makes it simple for us, and there is no limit to how many accounts or vendors we can track.

There are many 1099 filing apps that connect with Xero, and we have synced up Xero and Track1099 to make end-of-year filing super easy for many years. When we are ready to file, we are able to pass contact and transactional data from Xero to Track1099 so that we do not have to manually update forms, which would mean more potential for mistakes. Also, since TrackW9 and Track1099 are part of the same tool, W9 data can easily be passed along to Track1099 when it's time to file forms. Yet another reason to implement technology, rather than doing it the old-fashioned way.

Once all of your vendors are in Track1099 and it's time to electronically file your 1099-MISC and 1099-NEC forms, it's just a few clicks. You will review the forms, schedule e-File with the IRS and for any states requiring 1099s, and then the forms will be sent to your vendors via email (if you have provided an email address) or snail mail (if you didn't have an email address available).

Here is more information about the Track1099 filing process.

Are you worried that the 1099s you e-Deliver will fall into the wrong hands? Track1099 does not attach the PDF form to an email; instead, they send your recipients a secure link. Clicking on this link will take them to a secured site hosted by Track1099 where they must input the last 4 digits of their Tax ID in order to authenticate themselves. Should those numbers match what is found on their form, the vendor is then directed to an encrypted page that displays their document for download as a PDF file.

Here is a video regarding Track1099 e-Delivery.

Gone are the days when you only have to file 1099s with the IRS. Many states now want to be notified of any income their residents have received, in order to tie this back to their state income tax return.

Some states participate in the "Combined Federal and State program" which means that when you file 1099s with the IRS, the IRS passes this information back to the state on your behalf.

States currently participating in this program are: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Hawaii, Idaho, Indiana, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, South Carolina, Wisconsin

Track1099 can help to file 1099s in states where 1099s are required as the information is not passed back from the IRS. Some of these forms can be filed electronically using Track1099 and some still require that you mail or upload a form on their website. More information can be found on the Track1099 State 1099 FAQs here.

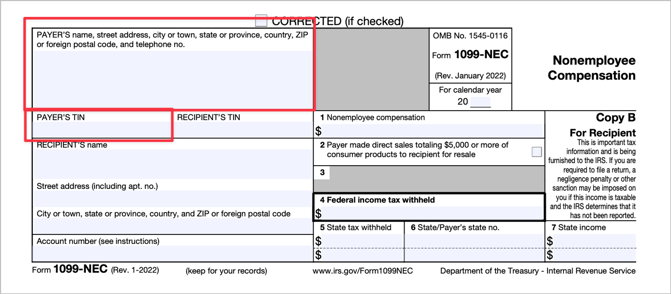

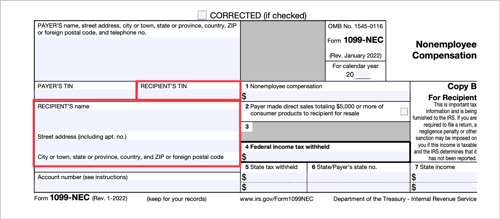

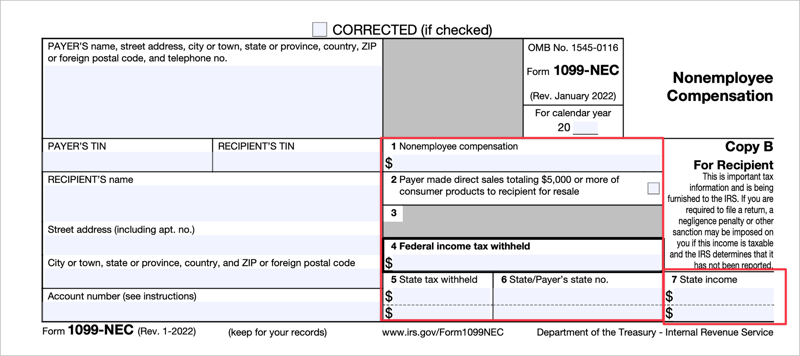

Below is an image of a 2022 IRS form 1099-NEC.

Starting in the top left is information for the PAYER.

The payer is your business name and the required information includes your:

Company Name

Address and Phone #

TIN.

A TIN is a Tax Identification Number. This is most commonly either an EIN (Employer Identification Number) or an SSN (Social Security Number), but can also be an ITIN (Individual Taxpayer Identification Number) or ATIN (Adoption Taxpayer Identification Number).

Acceptable IRS TINs can be found HERE

If you use Xero, the information required for these boxes populates from your Xero Organization Settings.

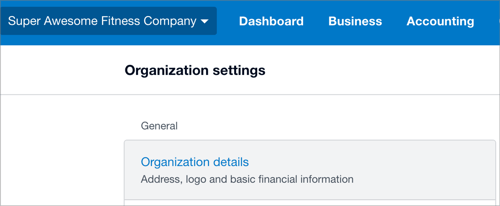

First, click the dropdown next to your company name.

First, click the dropdown next to your company name.

Then select Organizational Details.

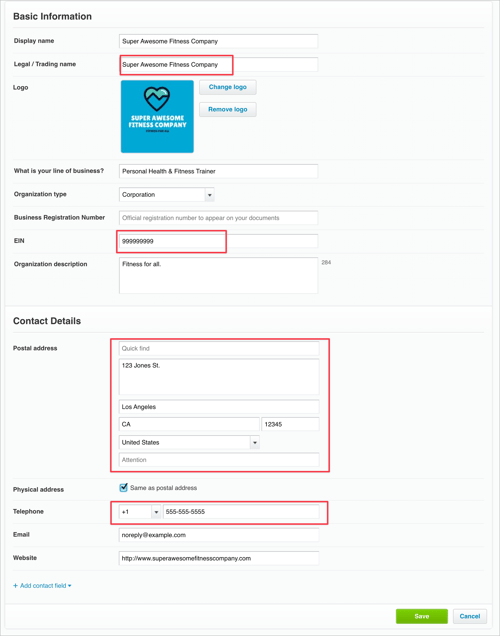

Here you can see your company's (aka The Payer's):

Here you can see your company's (aka The Payer's):

Legal Name

EIN

Mailing Address

Telephone Number

This information will transfer into Track1099, so it is important that this info is updated before you sync Track1099 and Xero.

Next is the RECIPIENT information, or the individual or company you paid.

Next is the RECIPIENT information, or the individual or company you paid.

The required information is:

Vendor Company Name

Address

TIN

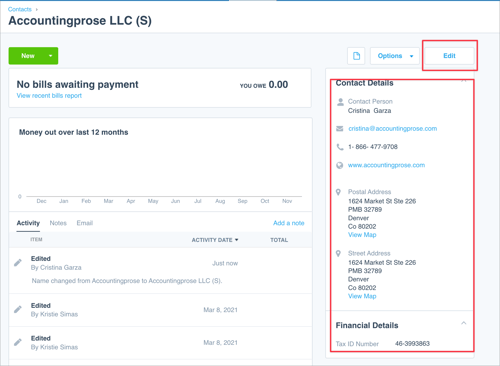

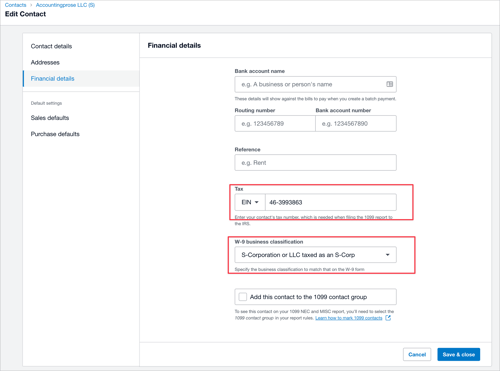

If you use Xero, you can view and edit the contact by going to the contact record.

On the right-hand side, you will see all pertinent W9 information.

You may click “Edit” if corrections need to be made.

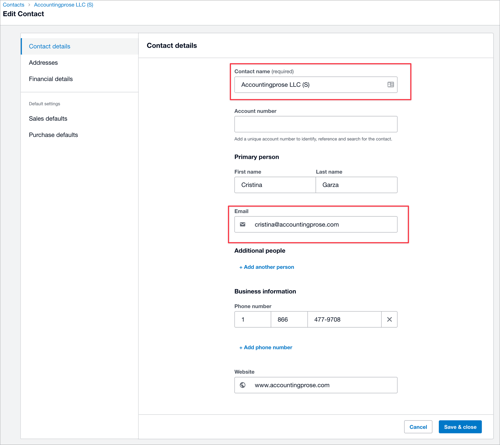

There are three menus, “Contact Details”, “Addresses”, and “Financial Details”.

Contact Details houses the following info:

Entity name

Email address - which is used to deliver the 1099

Phone number and website - both are not necessary to file 1099s

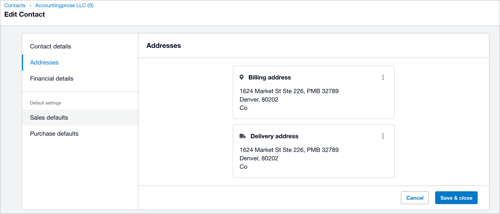

In “Addresses” you will see the billing and mailing addresses.

The billing address is used to deliver the 1099s if we cannot deliver them electronically.

The “Financial Details” contains the EIN and W9 classification.

It is important to complete the W9 classification so you only issue 1099s to those types of entities that require it.

|

Box # |

What's Included |

Notes |

|

1 |

Non-employee compensation (aka NEC) |

The most common box we use. You would also use this box to report payments to an attorney for legal services (vs settlements). |

|

2 |

If checked, consumer products totaling $5,000 or more were sold to you for resale, on a buy-sell, a deposit-commission, or another basis. |

|

|

3 |

Blank |

|

|

4 |

A payer must back up withhold on certain payments if a vendor did not give your TIN to the payer. |

|

|

5-7 |

State income tax withheld reporting boxes |

|

We typically just use Box 1 as most of the other boxes are relevant for our clients.

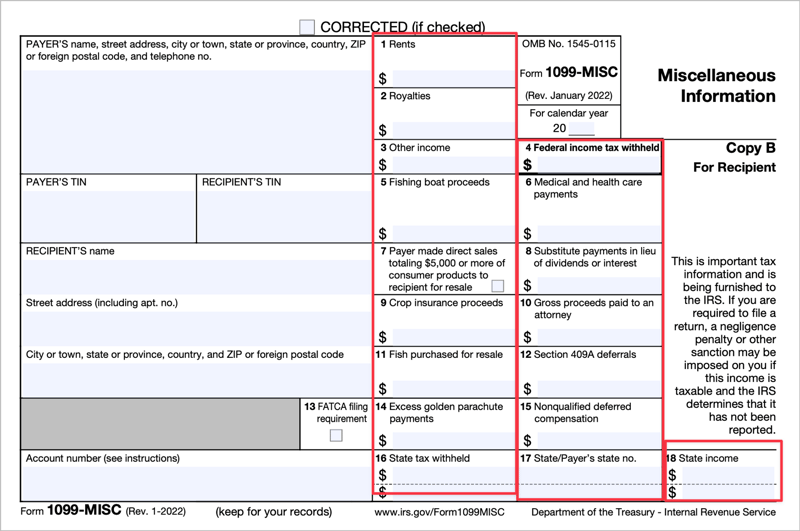

|

Box # |

What's Included |

Notes |

|

1 |

Rents |

The most common box we use. |

|

2 |

Report royalties from oil, gas, or mineral properties; copyrights; and patents. |

|

|

3 |

Generally, report this amount on the “Other income” line of Schedule 1 (Form 1040) and identify the payment. |

|

|

4 |

Shows backup withholding or withholding on Indian gaming profits. |

|

|

5 |

Shows the amount paid to you as a fishing boat crew member by the operator, who considers you to be self-employed. |

|

|

6 |

Medical and health care payments. |

|

|

7 |

If checked, consumer products totaling $5,000 or more were sold to you for resale, on a buy-sell, a deposit-commission, or other basis. |

|

|

8 |

Shows substitute payments in lieu of dividends or tax-exempt interest received by your broker on your behalf as a result of a loan of your securities. |

|

|

9 |

Crop insurance proceeds. |

|

|

10 |

Shows gross proceeds paid to an attorney in connection with legal services. |

Somewhat common |

|

11 |

Shows the amount of cash you received for the sale of fish if you are in the trade or business of catching fish. |

|

|

12 |

May show current year deferrals as a nonemployee under a nonqualified deferred compensation (NQDC) plan that is subject to the requirements of section 409A plus any earnings on current and prior year deferrals. |

|

|

13 |

NA |

|

|

14 |

Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. |

|

|

15 |

Shows income as a nonemployee under an NQDC plan that does not meet the requirements of section 409A. |

|

|

16 |

Show state or local income tax withheld from the payments. |

|

|

17 |

Show state or local income tax withheld from the payments |

|

|

18 |

Show state or local income tax withheld from the payments |

|

When filing a tax return, it's important to understand which forms you need to use in order to accurately report your total income. In some cases, you may be required to include multiple 1099 forms depending on what type of income you receive.

For example, if you receive both self-employment income and rental income during the year then you will need to file both a 1099-MISC and a 1099-DIV form. You should keep all forms for at least seven years, in case you are audited by the IRS or state in the future.

To ensure accuracy, it's best to double-check all information before filing your taxes, and if you see anything that needs to be edited, reach out to the person or company who sent it to you right away to make a correction

For small business owners, tax season can be an intimidating and tedious period of the year. Having to deal with filing taxes, staying up to date on changing tax laws, and understanding the different types of forms associated with taxes can be overwhelming. The 1099 Survival Guide is intended to help you understand the nuances of filing 1099s, and teach you everything they need to make tax season easier and less stressful!

If you are ready to kiss 1099s goodbye and have a professional file 1099s for you, do it for you, give a call! When you work with Accountingprose, you will never have to worry about collecting W9s or filing 1099s again!

Bench is a popular online bookkeeping service that works with clients around the U.S., just like us. We often have potential clients call us and ask,...

Closing Out 2017 As 2017 comes to an end, accountants across the United States will work diligently to close out their clients' books, so that tax...

After successfully processing nearly one hundred Paycheck Protection Program applications, we have some strong feelings about the program. Overall,...